As we mentioned in the previous post, the Licensing Show’s wrapping up today and there are always some lists and announcements and other observations that are very germane to where our world is going. It all starts with the product which leads to advertising which leads to media and here’s what we want.

Some stats on the top brands was released but it costs a few hundred buckaroonies to read it, so here’s the List Of The 20 Best-Selling Entertainment Products from Forbes last year. It’s still pretty accurate:

1. Disney Princess (Disney) $1.60 billion in 2011 retail sales

2. Star Wars (Lucasfilm) $1.50 billion

3. Pooh (Disney) $1.09 billion

4. Cars (Disney) $1.05 billion

5. Hello Kitty (Sanrio) $800 million

6. Mickey & Friends (Disney) $750 million

7. WWE (WWE) $700 million

8. Toy Story (Disney) $685 million

9. Peanuts (Iconix, Peanuts Worldwide) $600 million

10. Sesame Street (Sesame Workshop) $515 million

11. Disney Fairies (Disney) $435 million

12. Thomas the Tank Engine (Hit Entertainment) $390 million

13. Garfield (Paws Inc.) $370 million

14. Dora the Explorer (Nickelodeon) $330 million

15. SpongeBob (Nickelodeon) $330 million

16. Spiderman (Marvel/Disney) $325 million

17. Ben 10 (Cartoon Network) $295 million

18. Angry Birds (Rovio) $250 million

19. Batman (DC/Warner) $245 million

20. Barbie (Mattel) $242 million

A couple of observations on this:

— I sure hope those Man of Action guys have a piece of the Ben 10 licensing.

— Disney/Marvel/Star Wars is 8 of the top 20. Disney is the biggest licensing corporation in the known universe with $39.4 billion last year. According to Variety the rest of the studios rank like this

Warner Bros. – $6 billion

Nickelodeon (Viacom/Paramount) – $5.5 billion

DreamWorks Animation – $3 billion

Cartoon Network – $2.8 billion (They are orned by WB so not sure how this fits in with above number — either way still #2)

20th Century Fox – $2.35 billion

Sony – $1.2 billion “largely due from Spider-Man merchandise.”

The golden age of licensing is BACK baby, up 2.8% this year with nearly $2.55 billion in royalty revenue based on $49.3 billion in retail sales for “character based” licensing. (Licensing was huge in the 90s then dipped post 9/11 but has come roaring with as social media and mobile platforms have enabled brands to spread and created new brands like Angry Birds.)

Here’s a broader look at the top brands. Many are apparel based. It’s a bit of a shock to see things like the WWE ranked lower than Electrolux, but I guess the scandals have taken a toll.

1 Disney Consumer Products

2 Iconix Brand Group

3 Philips-Van Heusen Corporation

4 Meredith

5 Mattel

6 Sanrio

7 Warner Bros

8 Nickelodeon

9 MLB

10 Hasbro

11 The Collegiate Licensing Company

12 IBML

13 Westinghouse

14 Rainbow

15 General Motors

16 NFL

17 Electrolux

18 Dreamworks Animation

19 NBA

20 Pentland Group

21 Procter & Gamble

22 Cartoon Network

23 WeightWatchers

24 Ferrari

25 Ralph Lauren

26 20th Century Fox Consumer Products

27 Hit Entertainment

28 Kathy Ireland Worldwide

29 The Cherokee Group

30 Rovio Entertainment

31 BBC Worldwide

32 MGA Entertainment

33 Sesame Workshop

34 The Pokémon Company

35 Bluestar Alliance

36 Hershey’s

37 Giochi Preziosi Group

38 Perry Ellis International

39 Beverly Hills Polo Club

40 The Coca-Cola company

41 NBCUniversal

42 NHL

43 Sunkist Growers

44 U.S. Polo Assn.

45 WWE

46 Chrysler Group

47 Sony Pictures

48 Stanley Black & Decker

49 Fremantle Media Enterprises

50 Caterpillar

At this year’s show, Disney held a ‘special event for licensors and media and while as we’ve noted before the Disney Princesses line is the worldwide licensing leader, Marvel and Star Wars are for BOYS.

“With the industry’s most extensive franchise portfolio that includes the iconic Mickey Mouse, the mega boys franchise Marvel’s Avengers and top film franchise Star Wars, it’s critical that we continue to focus on the consumer and devise a strategy that aligns this rich and vast library of content with key markets and segments,” said Josh Silverman, executive VP, Global Licensing, Disney Consumer Products. “Our licensees and retail colleagues are poised for incremental growth opportunities as we drive the development of compelling new products and retail programs that complement each other across the spectrum.”

“Star Wars” and Marvel’s superheroes are especially being turned to as a way to target boys. While new animated series “Star Wars Rebels” will help fuel interest in the sci-fi franchise, J.J. Abrams’ “Star Wars: Episode VIII,” out in 2015, will do much of the heavy lifting, followed by standalone films tied to the “Star Wars” universe.

But don’t despair, according to Kidscreen a lot more girl oriented properties were on display this year, fueled by the success of Mattel’s Monster High.

“With more than 200 licensees across almost 30 countries and more than 45 categories, it’s a multi-category global franchise,” says Diane Reichenberger, VP of consumer products at Mattel. “Monster High has become a billion-dollar brand at retail in less than three years.”

According to Port Washington, New York-based research firm NPD, Monster High fashion dolls hold the number-one slot in category sales in Spain and are number two in the US, Germany, France, UK, Mexico, Canada and Italy. Additionally, with expert marketing executions including well-placed online animated content and a highly visible retail promotion in more than 1,200 US Kmart stores, sales generated by Monster High’s licensing program grew 290% worldwide and 190% in the US between 2011 and 2012.

The much-maligned Lego Friends brand of pink, tea-party focused Lego brick sets was also one of last year’s fastest growing brands. With Dora the Explorer out of the way, some licensing experts have seen a demand for something to take its place.

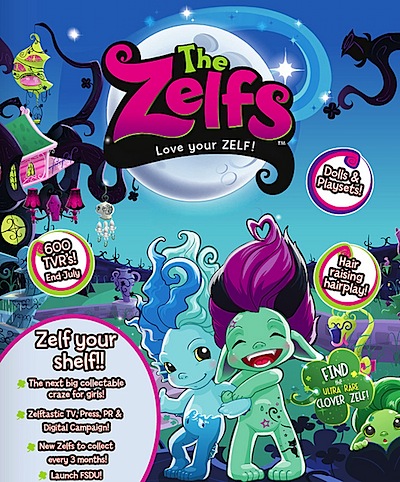

Among the hopefuls mentioned: The Zelfs, based on the Troll-like Australian toys; Pinkie Cooper, yet another fashion doll who is part Cocker Spaniel; (hold the jokes please); Mooshka from the company that brought you Bratz; and Gangnam Girls, based on a cartoon about five magical girls.

You’ll note all of these toys are based around fashion dolls; is it socialization or the innate nature of girls to dress up in high heels and play with Gumbies? Whatever it is, it is big, big business.

As I’ve mentioned before, Marvel and DC have no problem with outside licensing to the lucrative girls market; it is just not something that works inside the core brands.

A few more reports from around:

is Candy Crush the next Angry Birds?

The brand causing the biggest commotion on the show floor may be Candy Crush, a first-time exhibitor and a new licensor. Excited potential licensees seemed to think the addictive smartphone game, created by developers at the game maker King, is the licensing industry’s new Angry Birds. When I visited the Candy Crush booth, the brand’s VP of business development was holding court amid a swarm of would-be partners trying to pitch him ideas.

And King Features has some new properties:

King Features, the newspaper syndication and licensing company, is newly representing Chicken Soup for the Soul – for which licensed merchandise generated more than $200 million in retail sales in 2012 – as well as Archie Comics’ Archie & Veronica sub-brand. And British agency Copyrights Group was highlighting the classic British book and animation property The Snowman; a TV special, The Snowman and the Snowdog, will be broadcast this Christmas around the world. It recently assigned The Joester Loria Group as its U.S. agent.

I thought it was clearly indicated that Disney bought Marvel for the boys demo when they bought them. There is a reason why all the animated Marvel efforts are being launched on Disney XD, the “boys” network.

Yeah, I remember an article with John Lasseter talking about that disney has the girls demographic down-packed but they need to bring in the boys.

The whole Avengers is for boys thing is as much of a problem as My Little Pony is for girls. There is no brand-nazi at stores telling boys/men or girl/women not to like it. When I was younger I loved the Sanrio products and had a few Badtz Maru and Keroppi toys(and one Hello Kitty). the presentation of the product is not the end game of its consumption, it’s always up to the consumer in the end.

Comments are closed.