Meanwhile, at other comics companies, Skybound has been raising money to make video games. One of our frequent correspondents noted that ads to invest in Skybound had been appearing on their feed, and there is indeed a private “stock” offering for individual investors – but hurry, because it’s only open until April 3!

All the details can be found here, but to really drill down you’ll need to read the 300+ page investment circular. All of them show some large numbers – Skybound has not-so-stealthily been becoming one of the biggest comics/media companies in our little neck of the woods. The Walking Dead was a massive $10 billion hit; Invincible is one of Amazon’s biggest shows, and the Energon Universe has been selling lots and lots of comics while strengthening Skybound’s licensing chops.

So let’s take a look at this offering. “Stock” is $105 a share with a minimum investment of $525. Higher investments get various perks, including, for $150,000, dinner with Robert Kirkman and the rest of the Skybound team.

I put “stock” in quotes because this is not a public offering. It’s an “equity crowdfunding investment” in a “startup.” This is not the first time Skybound went to the public, either. In 2022 they raised $17,843,500 on Republic, the crowdfunding platform for businesses.

Now is not a great time for me to plow through 300 pages to get the facts on Skybound, but a few numbers from near the top are available. According to the circular, Skybound has 165 full-time employees and 2 part-time employees. That number alone is….astonishing.

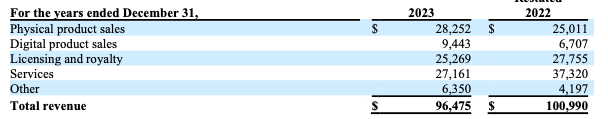

Skybound’s revenue is also robust: Skybound Holdings LLC reported revenue of $96,475,000 for 2023, down a bit from $100,990,000 in 2022. According to the Republic filing, they made $64,386,320 in 2021 and $42,877,688 in 2020. So some growth there.

However net income was not as good, with a loss of $6,947,000 in 2023, against a profit of $21,998,000 in 2022.

But where did this revenue come from? Sadly, the circular does not seem to include sales figures for the Energon Universe, however it does include this breakdown:

The Company generates revenue primarily through the sale of physical and digital product, licensing and royalties, and certain services, including production and marketing services. In accordance with ASC 606, the following table represents a disaggregation of the Company’s revenues (in thousands):

Licensing and royalties would include Walking Dead/Invincible media money, so you can see why people want to publish comics as IP.

All of this does give some idea of the size and scope of The Walking Dead phenomena – Skybound says it is the most watched cable show of all time, and they might just be right:

The Walking Dead has helped drive over $10B in revenue and market cap gains, including $1B+ for comics, games and novels at its peak in 2015

All of this, plus Invincible and Energon leads Skybound to have a total valuation of $625M. So just call Robert Kirkman “the $600 million dollar man” next time you see him.

Other numbers thrown around (quoting directly here.)

- Invincible Season 2 became the #1 revenue generating title on Prime Video globally and launched at #1 in 104 countries, with Season 3 out now, and Season 4 announced

- Launched the Energon Universe–our reimagined TRANSFORMERS and G.I. JOE comics shared universe—breaking multiple Hasbro sales records and selling over 4M+ copies to date.

- Expanded our most highly skilled leadership team to date, coming from companies like Wondery, Activision Blizzard, Electronic Arts, Warner Bros., Disney Animation, CBS, and DC Comics

- Established a growing games studio with top talent from the industry (one game in progress, two to come)

- Launched our international TV slate with the first seasons of Heart Attack (FujiTV), VAKA (Prime Video Nordics), Dime Tu Nombre (Prime Video Spain) and more set to be released in 2025 and 2026.

The main driver for future Skybound revenue seems to be video games – more on that in a moment, but comics get their slide in the deck:

Comics sales

- Doubled our comics business between 2023 – 2024

- In 2024, sold over 4.5M books generating over $23M in retail revenue

- Launched the Energon Universe, a reimagined TRANSFORMERS and G.I. JOE shared universe, resulting in the two most successful Hasbro comic book launches to date.

- $4M+ raised in GI JOE: A Real American Hero Kickstarter, the most funded comics Kickstarter ever

- Comics sold in over 30 territories and in 22 languages, generating $3M in recurring revenue

- Proven licensing and publishing success model with Hasbro, Universal, and LEGO

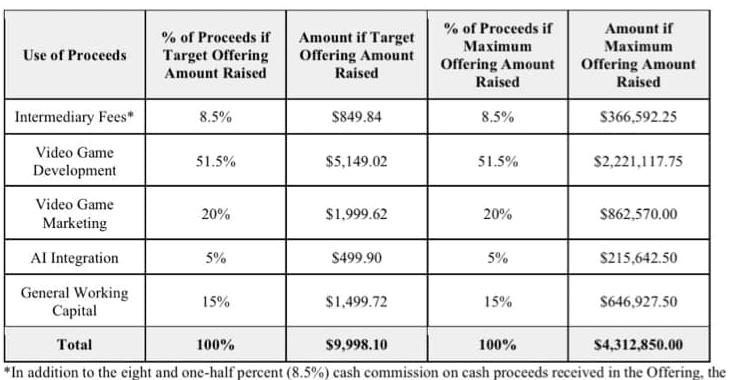

Comics may be great but the main focus for the investment is video games, as seen in this table which shows 51% of the money raised will go to video game development.

The video game highlights give some idea of where the money will go:

Video Games

- In house development, international publishing, and ARR from physical releases

- In house games studio being built by industry veterans from Activision Bilzzard, Electronic Arts, Amazon Games, and more

- $333M from Telltale’s The Walking Dead game; 80M units sold

- Goodnight Universe 2024 Tribeca Game Award Winner; Before Your Eyes BAFTA 2022 Game Beyond Entertainment Winner

- 2M units sold of VR Game The Walking Dead: Saints and Sinners

- Building a proprietary in-house game based on Invincible, with two additional games in development

I don’t know enough about the video game business to guess whether this will be a success or not, but I do know it’s a risky business.

All of this comes at a time when it’s being reported that two Skybound employees were laid off. Both games marketing manager Patrick Coyne, and director of social media and strategy Guillermo Cummings, reported being laid off on LinkedIn. A Skybound spokesperson stated that their positions were eliminated. With 165 employees, cutting two is not exactly a belt tightening to lure investors, and they have actually listed three job openings recently: an assistant editor, an editorial brand manager, and a production designer.

I have no idea whether investing in Skybound is a good idea or not. Certainly there are some impressive numbers here, and while The Walking Dead may have passed its peak, I suspect that it has survived long enough to enter Teenage Mutant Ninja Turtles territory: a lasting brand that will have various nostalgia boomlets. Invincible is still going strong, as well. Honestly, I’m still wrapping my mind around 165 employees.

This kind of investment is actually hard to collect on, though, according to a FAQ on the website:

The Common Interests (the “Units”) of Skybound Holdings LLC (the “Company”) are not publicly-traded. As a result, the Units cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: the Company gets acquired by another company; or the Company goes public (makes an initial public offering). In those instances, you typically receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your Units on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

So be like that guy in the Citizens Bank ad, and talk to your investment planner before making any moves!